DaDFiR3

Data-Driven Financial Risk and Regulatory Reporting

Our vision is a future regulatory financial reporting infrastructure that is versatile, lean, and pull-oriented working in a decentralized, diverse and fast-moving ecosystem.

Project Team Results Conference 2025About the Project

Our Vision: Reworking the reporting infrastructure.

We see a paradigm shift for financial regulation with:

- Timeliness, flexibility, transparency, comparability

- Improved adaptability to new situations

- Realistic systemic analysis

- Enhances regulators’ ability to mitigate adverse events

This will have an impact on the financial system and society:

- Financial institutions: Lower operations costs, better understanding of risks, freeing up resources for strategic tasks

- The financial system: More resilient, more efficient

- The real economy will profit from a more stable financial system

- “Society at large”: Improve financial market transparency & level the playing field between buyers and sellers

- Strengthening the role of Switzerland in FinTech

- Provides the foundation of a future digital financial infrastructure

This project is funded by

The Project Team

We are an interdisciplinary team with proven expertise in the individual fields.

Get into contact with us via LinkedIn

Results

We are developing a new generation of regulatory technology that has the potential to revolutionize the regulatory reporting practice. The development is carried out in close collaboration with industry and regulators with the aim to create solutions that make a difference for the financial industry and society as a whole. Stay tuned for the latest updates about our ongoing work!

2022

29.09.2022 Workshop on Automated Regulatory Financial Reporting

08.11.2022 NFT Event Rotkreuz: Recording

29.11.2022 Publication of a first small Demo Application to demonstrate the benefits of analysis of granular contract data.

2023

14.03.2023 Publication of Containerized Demo Application

14.04.2023 Ethereum Zurich: Talk and Workshop on Balancing the Goals of DeFi with Traditional Finance: A Risk Management Perspective

20.10.2023 Journal publication: Deciphering DeFi: A Comprehensive Analysis and Visualization of Risks in Decentralized Finance

14.12.2023 DaDFiR3 Vision

2024

2024 Book publication Chapter 12: Venturing into New Ways of Regulatory Reporting and Systemic Risk Analysis

15.02.2024 2nd International Workshop on Automated Regulatory Financial Reporting

02.04.2024 ETH-OXFORD Workshop on Mathematical Finance: Modelling Risk Transfer and Impact on Systemic Risk

05.04.2024 Ethereum Zurich: Workshop on DeFi Supervision - Who's task is it? Interactive Workshop on Risk Management

17.05.2024 Publication: Modelling risk sharing and impact on systemic risk

11.06.2024 Midterm Report SNSF Bern

Q3 and Q4 2024 Request for Proposals for industrial collaboration partner

Demonstrators

For recent updates and news follow us on LinkedIn

Past Events

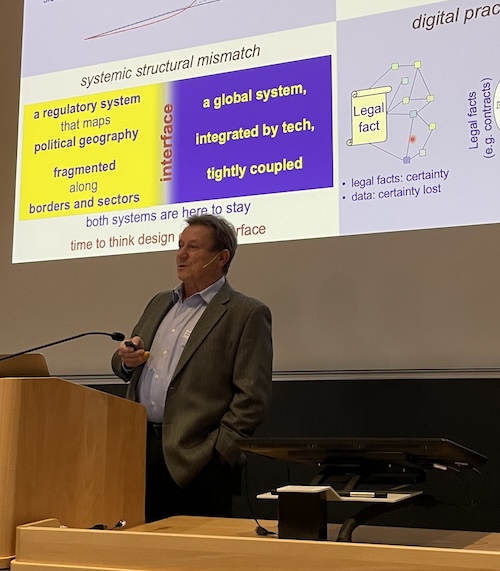

3rd International Workshop on Automated Regulatory Financial Reporting

Regulatory Financial Reporting: Ready for the Next Challenges?

13. February 2025

Agenda

12:00 Registration

13:00 Welcome Speech - Henriette Elise Breymann (ZHAW)

13:10 DaDFiR3 - Recent Achievements

Chair: Walter Farkas (UZH)

Risk Models, systemic risk simulation

Walter Farkas, Fabian Sandmeier (UZH)

Risk Factor interface & Business intelligence reporting

Francis Parr, Donat Maier, Patrick Hauf (ZHAW)

ACTUS meets DeFi

Tim Weingärtner, Hongyan Sun (HSLU)

14:10 Networking break

14:40 Invited Talks - International developments

Chair: Tim Weingärtner (HSLU)

New BCBS regulations on Counterparty Credit Risk

Fabrizio Anfuso (Bank of England)

Reverse Stress Testing

Eric Schaanning (Nordea Bank)

Open Banking: Opportunities and risks for the traditional banking industry

Gisela Reichmuth (ZHAW)

EKE: Challenges of Granular Reporting in Switzerland

Jan Melin (BearingPoint)

16:00 Networking break

16:20 Case Studies

Chair: Henriette Elise Breymann (ZHAW)

ECB Project: Life with and without AnaCredit

Francis Gross (ECB)

ACTUS for urble, the Emperor’s New Clothes?

Ralph Hofacker (Brick Towers)

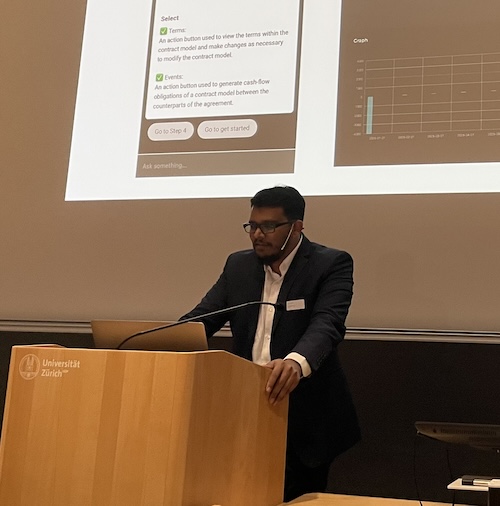

Contract Studio

Shirish Kalangi

ACTUS Competition

Henriette Elise Breymann (ZHAW)

17:20 Round table discussion: Traditional Finance vs. DeFi: Systemic Risk, Regulatory Blind Spots & The Role of Granular Risk Reporting

Moderator: Patrick Hauf (ZHAW)

Ralph Hofacker (Brick Towers)

Fabrizio Anfuso (Bank of England)

18:00 Apéro

Location

The conference was located at

University of Zurich, KOL-F-101

Zurich, Switzerland.

2nd International Workshop on Automated Regulatory Financial Reporting

15. February 2024

Agenda

12:00 Registration

13:00 Welcome Speech - Henriette Elise Breymann (ZHAW)

13:10 DaDFiR3 - Where do we stand today

Chair: Walter Farkas (UZH)

Container-based infrastructure

Francis Parr, Donat Maier (ZHAW)

Modelling Risk Transfer and Impact on Systemic Risk

Walter Farkas, Patrick Lucescu (UZH)

DeFi takes Risk to a new level

Tim Weingärtner (HSLU)

14:15 Networking break

14:45 Latest developments in supervision

Chair: Tim Weingärtner (HSLU)

Data-based banking supervision in Switzerland

Philippe Brügger (FINMA)

Can government booster financial innovation? And should it?

Eva Selamlar-Leuthold (FIND)

ECB banking supervision approach on data, technology, and innovation

Moritz Karber (ECB)

15:50 Networking break

16:10 Financial regulation: Towards the future

Chair: Henriette Elise Breymann (ZHAW)

ZK ACTUS - Towards verifiable financial contracts

Mark Greenslade (Casper Association)

Analysis of SVB's breakdown: Was the collapse foreseeable?

Gian-Andrin Tommasini (ZHAW)

Forward looking regulation

Willi Brammertz (ARIADNE)

17:15 Panel discussion: Towards regulation in distributed finance

Moderator: Patrick Hauf (ZHAW)

Magdalena Boškić (Sygnum Bank)

Ralf Kubli (Casper Association)

Francis Gross (ECB)

18:00 Apéro

Location

The conference was located at

University of Zurich, KOL-F-101

Zurich, Switzerland.

Speakers

Magdalena Boškić

Head RegTech & Crypto Compliance Services, Sygnum

Willi Brammertz

Ariadne Business Analytics AG

Philippe Brügger

Head of Analyses and Instruments. FINMA

Mark Greenslade

Head of R&D, Casper Association

Francis Gross

Senior Advisor, ECB

Moritz Karber

Supervisor Subtech, ECB

Ralf Kubli

Board Member, Casper Association

Eva Selamlar-Leuthold

Head Swiss Financial Innovation Desk. Federal Department of Finance

1st International Workshop on Automated Regulatory Financial Reporting

29. September 2022

Currently, ZHAW, HSLU and University of Zurich in close collaboration with interested parties from the industry and funded by the SNCF-Bridge scheme are pursuing the vision of a system for automated regulatory financial reporting that uses financial contract-level data combined with market data to automatically produce the analyses required for internal and external oversight.

The workshop aims at presenting details of the project as well advantages from the point of view of different stakeholders (regulators, financial institutions, technology providers, standard-setting bodies). Our objective is to start a conversation among those stakeholders and create an impact on their vision.

The workshop will take place a day after the 7th European Conference on AI in Industry and Finance in Switzerland

Agenda

12:00 Registration

13:00 Welcome Speech - Prof. Dr. Henriette Elise Breymann

13:30 Vision for European Banking Supervision - Lukasz Kubicki

14:00 Freeing Schrödinger's Cat - Investors Perspective on Regulatory Reporting - Christian Dreyer CFA

14:30 Networking break

15:00 ACTUS Demo - Francis Parr

15:30 ACTUS Bank Perspective - Ioannis Akkizidis

16:00 Short break

16:15 Data-based banking supervision in Switzerland - Dan Wunderli

16:45 Panel discussion

Moderator: Prof. Walter Farkas

Alistair Heggie

Jörg Behrens

Lukasz Kubicki

17:30 Apéro riche

Location

The conference was located at

Zurich University of Applied Sciences

School of Engineering

Building TN, Room E0.54, Technikumstrasse 71, Winterthur.

Speakers

Lukasz Kubicki

Head of SupTech, Technology and Innovation, ECB

Christian Dreyer CFA

Independent Analyst and Investor

Francis Parr

Visiting Researcher and former Research Staff Member at IBM Research

Ioannis Akkizidis

Lead Technology Product Manager Finance, Risk & Regulatory Reporting, Wolter Kluwers

Dan Wunderli

Head of Data Innovation Lab at FINMA

Alistair Heggie

Chief Operating Officer, SEBA Bank AG

Jörg Behrens

Non Executive Director and Entrepreneur